The pitfalls of efficiency: Optimise budgets to maximise profit, not ROAS

Daniel Porcelli

Digital Specialist

Ecommerce businesses constantly strive for growth through digital marketing. During turbulent times, enhancing profitability becomes paramount, and many will misguidedly focus on maximising return on ad spend (ROAS) to boost profits.

However, pursuing marketing efficiency and achieving a high ROAS can inadvertently lead to a downward spiral in performance, harming overall growth and profitability.

In this article, we’ll explore the pitfalls of efficiency and look at shifting the focus towards effectiveness to unlock profitable growth. We’ll examine the North Star metric that enables businesses to evaluate the direct bottom-line profits of their digital marketing efforts. Finally, we’ll delve into a practical example, showing how to determine the optimal ROAS target to maximise absolute profit, considering variable costs and diminishing marginal returns.

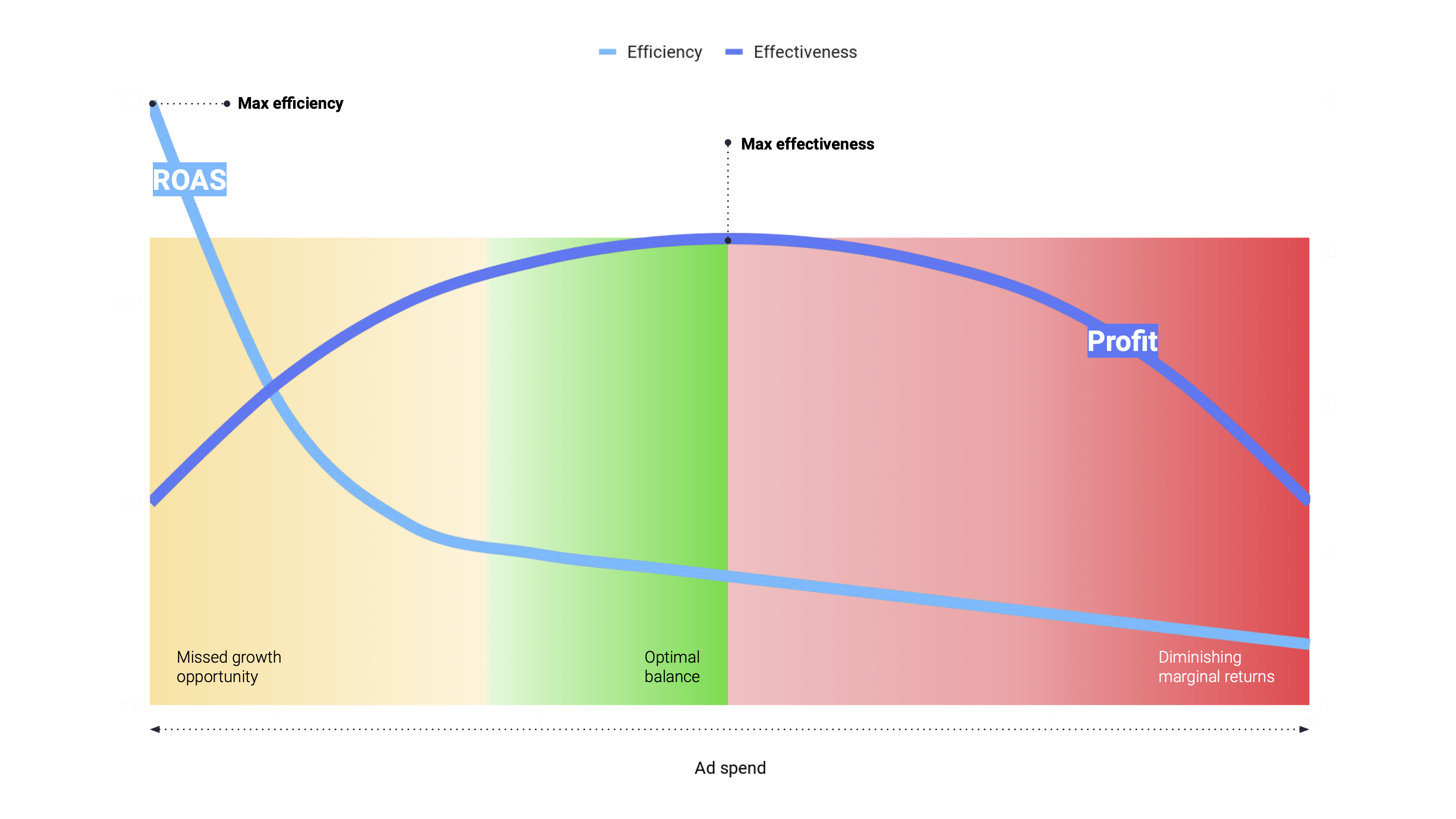

Balancing efficiency and effectiveness

Ecommerce businesses aiming for profitable growth constantly face the challenge of balancing cost-efficiency and scaling their advertising investments. This challenge becomes more pronounced during periods of financial uncertainty when profit margins are tight.

Frequently, efficiency is prioritised as a shortcut to boost performance and the profitability of digital marketing. In fact, in a new study, four out of ten marketers say that improving marketing ROI is their number one priority for 2024.

However, efficiency is counterintuitive, and a digital marketing strategy that falls into the trap of trying to maximise ROAS compromises short-term effectiveness, resulting in missed growth opportunities and reduced profits that will lead to a misalignment between business goals and marketing objectives.

Overemphasising efficiency can even run you out of business if the short-term effects of performance marketing are not balanced with the long-term impact of brand-building. Over time, neglecting branding to drive short-term efficiency can lead to a decline in brand equity, resulting in diminished customer loyalty and increased price sensitivity, ultimately eroding profit margins.

While efficiency should not be dismissed, it’s essential to strike a balance between minimising costs and maximising effectiveness to enhance the profitability of digital marketing in both the short and long term.

The critical drawbacks of ROAS

The popularity of ROAS in e-commerce is undeniable, serving as the primary metric for assessing marketing campaign performance, guiding budget allocation, and assessing the overall success of digital advertising efforts.

Many businesses consistently pursue a specific ROAS target. However, for many less mature businesses, setting this target can be arbitrary, either assuming that higher is always better or relying on past achievements without considering market dynamics and changes in competition.

Mature businesses may meticulously calculate their break-even ROAS. Still, while this approach appears to be better than purely guesstimating, it remains flawed, nonsensical even, since ROAS doesn’t consider volume or profitability.

While ROAS may seem straightforward to monitor, many overlook its potential for being misleading due to conversion lag — the time between the initial ad click and purchase. Furthermore, many also fail to recognise that they might miscalculate their ROAS if they rely on revenue reported in ad platforms, including VAT, as ad spend does not.

It’s crucial to understand that ROAS has critical drawbacks:

- ROAS limits growth

Optimising for a high ROAS can heavily restrict growth by limiting the reach of advertising campaigns, focusing primarily on high-intent customers and overlooking potential incremental sales from customers with lower purchase intent. A too-high target constrains scalability, while an excessively low target results in wasted ad spend as diminishing marginal returns set in. - ROAS neglects profitability

While a high ROAS is often seen mistakenly as a profitability driver, achieving a higher ROAS does not necessarily equal more profit. On the contrary, having too high targets could lead to prioritising high-priced, low-margin products that achieve high efficiency but erode margins, resulting in reduced profitability. - ROAS promotes short-termism

ROAS favours short-term revenue, attributing success to lower-funnel activities. This simplification of the customer journey overvalues performance marketing at the expense of long-term brand-building, growth, and efficiency. This imbalance can lead to suboptimal budget allocation, causing a loss of market share and diminishing the total impact of marketing in the long run.

Contribution margin as the North Star

Using ROAS as a proxy metric for assessing the effectiveness and profitability of digital marketing efforts is misleading and can be detrimental to business in the short and long term.

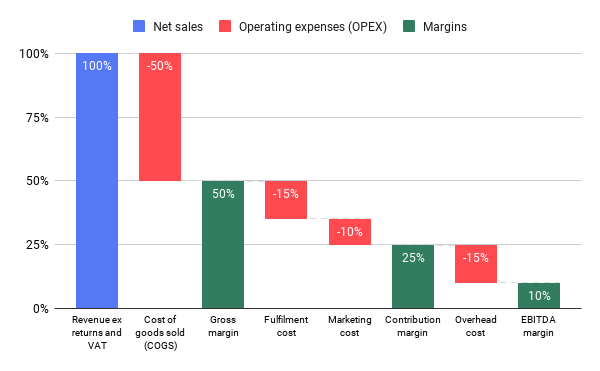

Instead, e-commerce businesses should focus on contribution margin, which measures absolute profit after accounting for variable costs and marketing. It provides clarity and aids in understanding the profitability of marketing efforts, considering ad spend.

Contribution margin considers all variable costs, including ad spend, to show bottom-line profit before fixed costs.

Contribution margin should be the North Star KPI for e-commerces seeking to confidently enhance their profits and scale advertising investments across channels.

Let’s break down what contributing margin is with a simple example:

Let’s say we’ve spent €1,000 on a digital marketing campaign, and the net sales (revenue excluding VAT) generated is €3,000, with a €1,500 cost of goods sold (COGS) and fulfilment cost.

To calculate the absolute contribution margin:

- Contribution margin = net sales – variable costs

= €3,000 (net sales) – €1,500 (COGS and fulfilment) – €1,000 (ad spend) = €500

In this example, the absolute contribution margin is €500. This means that the marketing campaign has generated €500 in direct profit contribution, which can be used to cover overhead costs and generate a net profit.

Businesses analysing contribution margins can understand the direct profit of various marketing campaigns. This valuable insight allows for optimising digital marketing profitability by allocating resources effectively, accounting for diminishing marginal returns, and evaluating the impact of budget and target changes directly on the bottom line.

Optimal target ROAS for maximising profit

With contribution margin as the new North Star for evaluating marketing profitability, we aim to optimise ROAS for maximum profit by introducing the concept of marginal profit on ad spend (POAS).

- Marginal POAS | Profit return on incremental ad spend

[Marginal (Net Sales – COGS – Fulfilment Cost) / Marginal Ad Spend]

Marginal POAS helps us understand the incrementality of profit returns as we scale ad spend and adjust ROAS, guiding us in determining when further increasing ad spend becomes ineffective.

Evaluating performance based on absolute profit (contribution margin) and diminishing marginal returns (marginal POAS) empowers us to set optimal ROAS targets for maximising short-term profits.

Before looking at a practical example, let’s break down the process of determining the optimal ROAS target into three steps:

- Forecast ad spend and revenue

Use advertising platform tools (such as Google Ads Performance Planner) or third-party solutions to manually forecast short-term (weekly or monthly) ad spend and revenue. This offers insights into predicted revenue at various ad spend levels, considering recent performance and seasonality. It’s crucial to validate forecasts by comparing them to actual performance and making adjustments. Cutting-edge forecasting tools automate this process and continuously validate results, showing the confidence intervals of the model’s prediction to help assess the forecast reliability. - Calculate profitability metrics

Combine the forecast with variable costs and margin insights to calculate key profitability metrics, including contribution margin and marginal POAS for each corresponding ROAS target. - Balance effectiveness and efficiency

Using the profit calculations, assess the impact of scaling ad spend. With a clear understanding of the predicted profit and marginal efficiency, determine the optimal ROAS target for maximising absolute profit in the short term by balancing effectiveness and efficiency.

Practical example: Determining the optimal target ROAS for maximising profit

Let’s illustrate this process with an example:

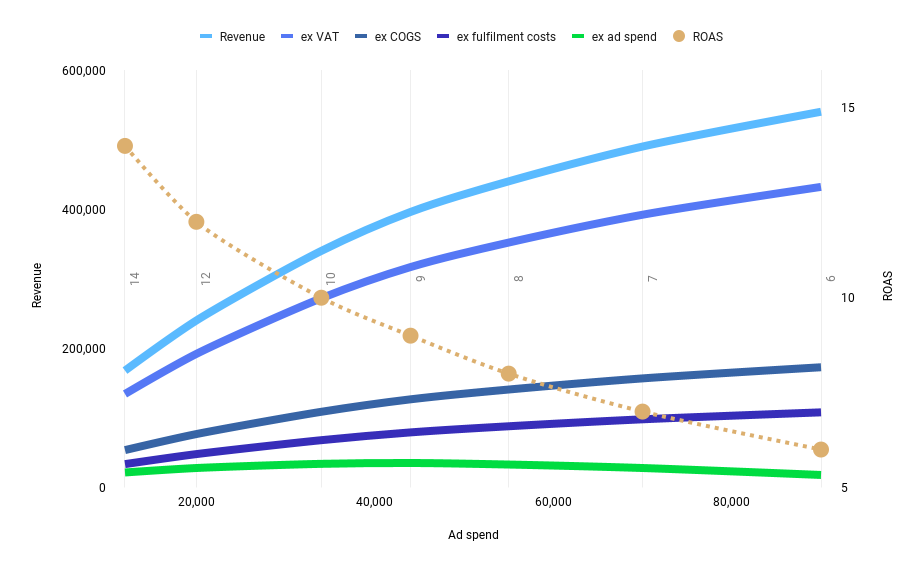

Suppose we run a sales activation campaign with a target ROAS of 14. We aim to see if reducing ROAS and increasing ad spend will boost the absolute contribution margin, thereby improving overall profitability.

The table below displays forecasted revenue at different ad spend levels. To evaluate profitability, we must consider variable costs, starting with net sales. This means removing VAT where applicable from the revenue forecasted and ideally factoring in all discounts and average return rates.

Profit metrics calculated from ad spend and revenue forecast: Example: GM1 = 40.0% | GM2 = 25.0%

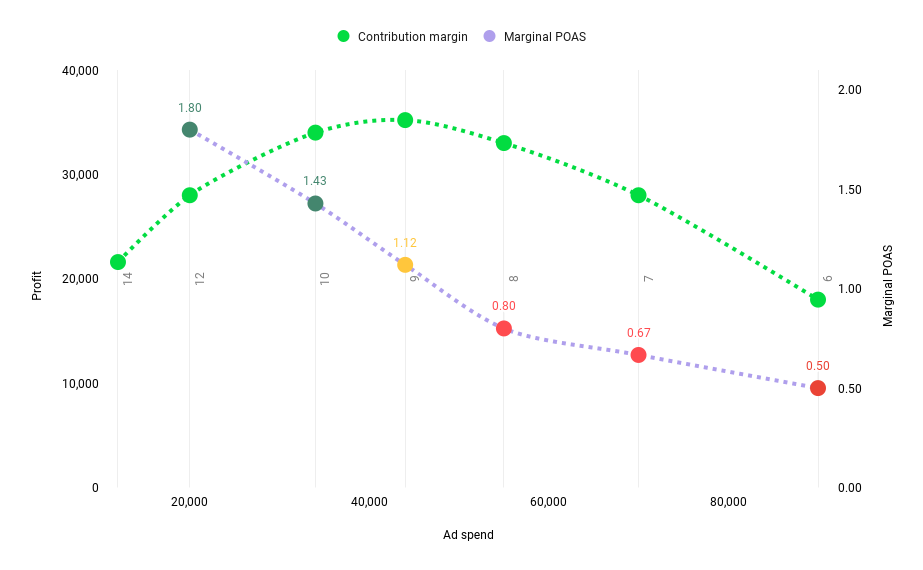

In this example, the table suggests that a ROAS of 9 is expected to generate the highest absolute profit. However, when considering marginal POAS, adjusting the ROAS target from 10 to 9 is only marginally profitable and comes with an increased risk of reaching diminishing returns, potentially leading to wasted ad spend if the forecast is slightly off.

Saturation curves

Visualising the saturation curves can help further illustrate diminishing returns. In this example, ROAS 9 is predicted to maximise performance effectiveness and contribution margin. Scaling beyond this point will result in diminishing returns. Examining marginal profit reveals that the incremental ad spend increase when adjusting ROAS from 10 to 9 is inefficient and only marginally profitable at a 112% return.

Figure A illustrates how ROAS targets correlate to net sales, gross profit, and contribution margin.

Figure B zooms in 15x to display the optimal ROAS, balancing effectiveness (absolute profit) and efficiency (marginal returns).

Results

This example suggests that ROAS 10 is the optimal target for maximising contribution margin in the forecasted period. Scaling beyond this point poses a high risk of diminishing returns and a loss in absolute profit.

Calculating the deltas from the target adjustment shows the absolute and percentage change in ad spend, net sales, and contribution margin, respectively. This demonstrates that a 29% decrease in ROAS is predicted to drive a 183% increase in ad spend, resulting in top-line growth of 102%, offsetting the reduced efficiency and ultimately driving a 57% increase in direct bottom-line profit.

Conclusion

In summary, balancing cost-efficiency and scaling advertising investment is a constant challenge for ecommerce businesses striving for profitable growth. However, pursuing a high return on ad spend (ROAS) has critical drawbacks. It encourages short-term focus, leading to missed growth opportunities, reduced effectiveness, and declining profits.

To assess the profitability of digital marketing efforts, businesses should instead focus on contribution margin. This metric measures absolute profit after variable costs and marketing. It guides decision-making by revealing whether changes to budgets and targets positively or negatively impact bottom-line profitability.

Combining contribution margin with marginal profit on ad spend (POAS) helps determine the optimal ROAS target for maximising profit, considering diminishing marginal returns. This approach ensures a more effective and profitable digital marketing strategy, aligning marketing objectives and business goals.

Ultimately, businesses can aim to maximise short-term profitability by relying on contribution margin as their North Star metric, empowering them to enhance digital marketing effectiveness and avoid the pitfalls of focusing solely on efficiency.

Get in touch with us to learn more about how you effectively drive profitability in your business.